What is the Inflation Reduction Act?

Signed into law in August 2022, the Inflation Reduction Act has allocated over $369 billion in the form of tax credits and rebates to benefit homeowners who make energy efficient upgrades. For families who purchase heat pumps or other energy efficient home appliances, this new legislation provides savings of more than $14,000 in consumer rebates and tax incentives. These energy efficient upgrades can save homeowners in Plainfield, Indiana over $600 annually on their energy bills. While rebates are will not be available until the end of 2023, tax credits are available now to all customers.

Have you been considering an upgrade to your home’s HVAC system, water heater, and electrical box? Now may be the best time with the incredible savings that are available on your new equipment and installation costs provided by the Inflation Reduction Act.

TAX CREDITS AVAILABLE

January 1, 2023

Book an Appointment

Want to save money and prevent future problems?

Bassett Watchdog Home Coverage Club

$18 Per Month Will Get You:

- 20% Savings On HVAC Service

- 10% Savings on Plumbing Service

- 10% Savings on Electrical Service

- 2 Annual HVAC Maintenance Services

- 1 Annual Plumbing Maintenance Service

- 1 Annual Electrical Maintenance Service

- No Overtime Charges

- Summer/Winter No-Breakdown Guarantee

- And MUCH More!!!

Your Comfort is Our #1 Priority

At Bassett Services, we make your needs our #1 priority. This drives our every decision and action, motivating us to provide top-tier cooling services that stand out.

When you choose Bassett Services for your cooling needs, you are choosing a dedicated partner, not just a service provider. Our process begins with a thorough understanding of your unique needs and challenges.

We don’t believe in one-size-fits-all solutions. Instead, we focus on providing personalized service that addresses your specific requirements.

We offer a wide array of cooling services in Indianapolis, IN, including:

Air Conditioning Repairs & Installations

When your AC system fails, it can disrupt your peace and comfort. Our team of skilled technicians swiftly responds to your call, diagnosing the issue accurately.

Once we identify the problem, we inform you about the necessary repairs and the associated costs.

We aim to fix issues as quickly as possible. If a new installation is needed, we guide you through the process, recommending the best systems to suit your needs, home size, and budget.

Our technicians then carry out the installation with professionalism and precision. This ensures your new HVAC system runs optimally for maximum comfort.

Smart Thermostat Services

We believe in the power of technology to enhance comfort and convenience. Our smart thermostat services help you take control of your home’s temperature with ease, whether you’re at home or on the go.

We help install and configure smart thermostats, guiding you on how to use them for maximum energy efficiency and comfort.

Air Conditioning Replacements

When your air conditioner reaches the end of its lifespan, we can provide seamless and hassle-free replacement services.

Our experts provide unbiased advice on the best energy-efficient models, considering factors such as your home’s size, your budget, and your cooling needs. We then perform the installation, ensuring everything is set up for optimal performance.

Indoor Air Quality Services & Air Ducts

When your air conditioner reaches the end of its lifespan, we can provide seamless and hassle-free replacement services.

Our experts provide unbiased advice on the best energy-efficient models, considering factors such as your home’s size, your budget, and your cooling needs. We then perform the installation, ensuring everything is set up for optimal performance.

Why Choose

Bassett Service

Today’s heating/cooling systems are more efficient and use more sophisticated digital controllers for their operations. Proper installation and maintenance is important and having the right technicians and service people to ensure proper operations is critical. Bassett Services has a special process for selecting individuals who can perform the technical functions that are required to service the equipment we sell and, most importantly, interface with our customers on a very professional level!

Our Most Recent Reviews

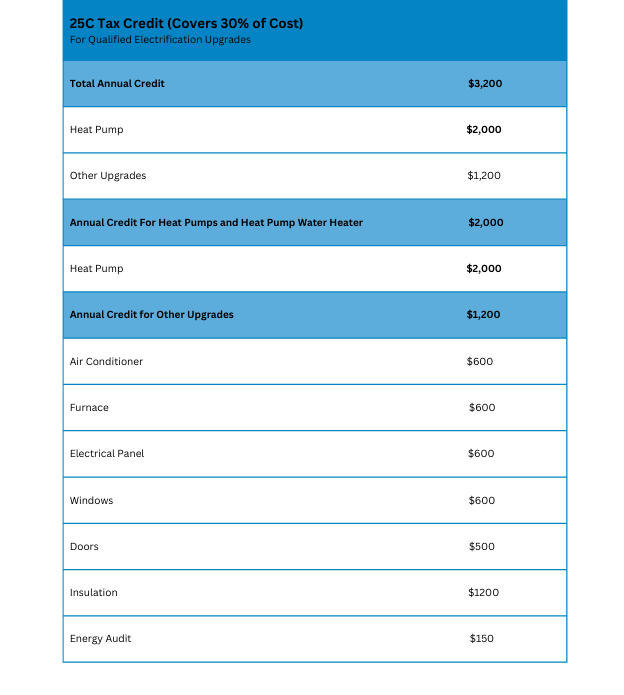

25C Energy Efficient Home Improvement Tax Credit

From January 1st, 2023, households can benefit from built-in credits for making energy-efficient choices under the Inflation Reduction Act, resulting in savings on taxes. An example of this is the Energy Efficient Home Improvement Tax Credit, which expands the 25C tax credit. Homeowners can now deduct up to 30% of the total cost of specific home improvements, with an annual limit of $3200. However, it’s important to note that the upgrades must meet relevant requirements of the Consortium For Energy Efficiency and Energy Star to be eligible for factoring into your tax credit. Overall, this is an excellent opportunity to save money while also making your home more energy-efficient.

Do I qualify for the 25C Energy Efficient Home Improvement Tax Credit?

Yes, everyone is eligible for the 25C tax credit. There are no income qualifications for tax credit. Anyone with adequate tax liability to offset can qualify.

Does 25C have efficiency requirements?

Yes, 25C upgrades must meet the Consortium for Energy Efficiency’s highest non-advanced tier and Energy Star requirements. Our professionals at Bassett Services can help you select the right upgrades to qualify for the 25C tax credit.

How Do I Claim my Tax Credits?

Our team at Bassett Services will provide you with all the proper documentation to easily claim your home upgrade tax credits when you file your taxes.

Our home service professionals at Bassett Services can provide you with expert help and guidance when you are ready for your energy efficient upgrades.

Contact us online or call (317) 360-0054 to schedule your free home energy analysis today.

What’s to Come With Rebates….

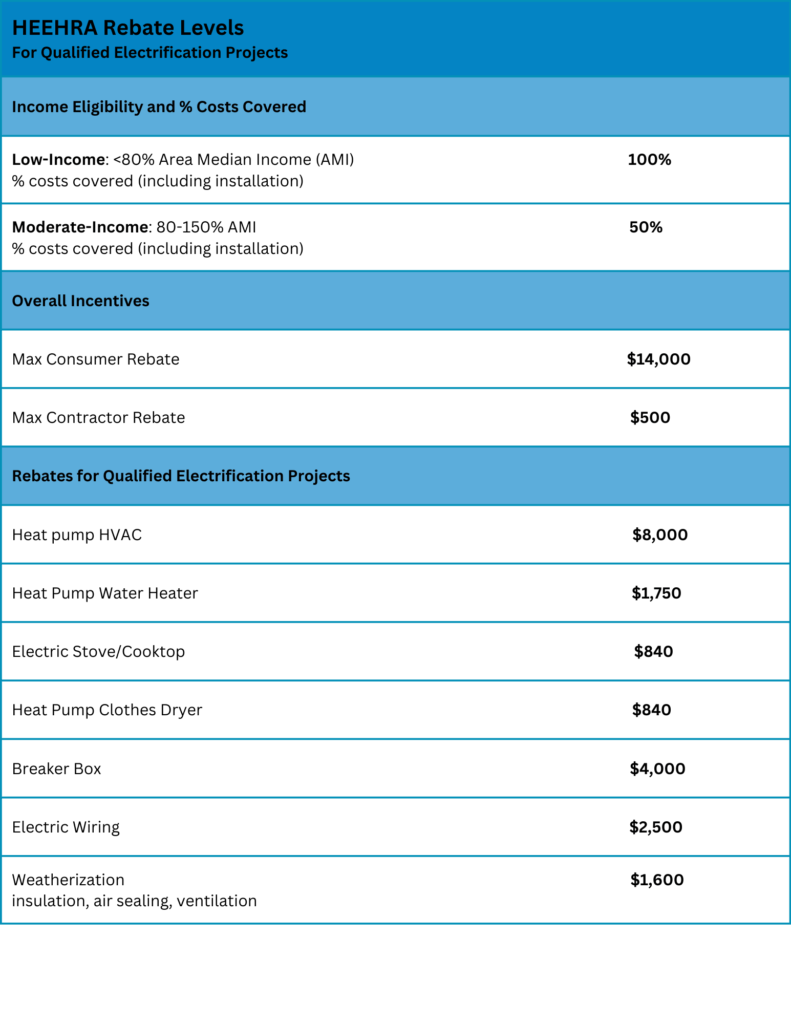

High-Efficiency Electric Home Rebate (HEEHRA)

To help low- and middle-income homeowners save on energy-efficient upgrades, the High-Efficiency Electric Home Rebate program provides instant discounts at the point of sale. Through this program, eligible households can save up to $14,000 on upgrades, with the rebate covering the full cost of electrification for low-income households and 50% of the cost for moderate-income households, including equipment and professional installation. To qualify for this program, households must have an income below 150% of the area median. This program provides an excellent opportunity for eligible homeowners to make energy-efficient upgrades to their homes while saving money.

Are Rebates Available Now?

The HEEHRA and HOMES rebate is not available right now, but rebate programs will start sometime at the end of 2023 or beginning of 2024 through your State Energy Offices. The timing of these depends on your state of residence and on the Department of Energy guidance, so be sure to check with Bassett Services to see if rebates are available when you’re ready to purchase.

Tax Credits and Rebates—what’s the difference?

A tax credit is money that will be given back to customers when they file their taxes. Families can earn up to $3200 in tax credits with the 25C tax credit every year. Conversely, a rebate is an off-the-top discount at point of sale and will provide customers with upfront savings. Rebates will not be available until end of 2023 or the beginning of 2024. Contact Bassett Services to stay updated on the latest news on when rebates will be available in Plainfield, Indiana.

Does 25C have efficiency requirements?

Yes, 25C upgrades must meet the Consortium for Energy Efficiency’s highest non-advanced tier and Energy Star requirements. Our professionals at Bassett Services can help you select the right upgrades to qualify for the 25C tax credit.

Whole Home Energy Reduction Rebate Program (HOMES)

To encourage energy conservation, the HOMES rebate program offers reimbursement to homeowners who make whole-house energy improvements. Eligible households can receive $2000-$8000 in rebates, depending on the amount of energy saved. Low- and middle-income households can receive $4000-$8000 or 80% of project costs, while high-income households can receive $2000-$4000 or 50% of project costs, for energy savings of 20%-35% or more. The rebates are based on energy savings performance, measured by a threshold of either 20% modeled savings (pre-upgrade) or 15% measured savings (post-upgrade), with larger rebates for greater energy savings. Low- to moderate-income households can qualify for up to $8000 in rebates and 80% of project costs. The HOMES rebate program is open to all households, but low- and middle-income households may receive more significant cashback. This program offers an excellent opportunity for homeowners to save energy and reduce their expenses.

Do I qualify for the 25C Energy Efficient Home Improvement Tax Credit?

Yes, everyone is eligible for the 25C tax credit. There are no income qualifications for tax credit. Anyone with adequate tax liability to offset can qualify.

Does 25C have efficiency requirements?

Yes, 25C upgrades must meet the Consortium for Energy Efficiency’s highest non-advanced tier and Energy Star requirements. Our professionals at Bassett Services can help you select the right upgrades to qualify for the 25C tax credit.

How do I save on my home upgrades today?

Take advantage of the 25C Energy Efficient Home Improvement tax credit and ask our professionals at Bassett Services show you can maximize savings with qualified energy efficient upgrades. The Bassett Services team is ready to help you every step of the way.

What You Can Anticipate When Contacting a Home Heating Expert from Bassett Services

Our courteous HVAC technicians will visit your residence, conduct a thorough assessment of your heating system, and furnish you with a comprehensive report that outlines recommended solutions. Prior to commencing any work, we are committed to ensuring complete transparency by offering upfront pricing details and a breakdown of associated costs.

We take great pride in our reputation as a trusted provider of home heating services in the Indianapolis, IN vicinity. Our unwavering commitment is to guarantee 100% satisfaction for all our endeavors, whether it’s repairs, maintenance, or heating system installations.

For home heating services near Indianapolis, IN, you can rely on, Bassett Services is at your service today. Your satisfaction is our top priority. We’ll be there on time and complete the job in no time!

Some of the typical heating and cooling services offered by our HVAC technicians include:

- Diagnostic assessments for furnace and heating system repairs to identify issues and provide solutions.

- Replacement of outdated heating systems with new, high-efficiency units.

- Annual heating tune-ups prolong the lifespan of your heating system, ensuring it serves you for many years.

- Installation of ductless mini-split systems in individual rooms, enabling temperature control without the need for ductwork.

- Expert inspection and repair of cooling and air conditioning systems in your home by our skilled HVAC technicians.

Contact Bassett Services Today For:

Our Promises

OVER 40 YEARS OF HAPPY CUSTOMERS

RESPECTFUL FAMILY FRIENDLY SERVICE

CONVENIENT PAYMENT OPTIONS